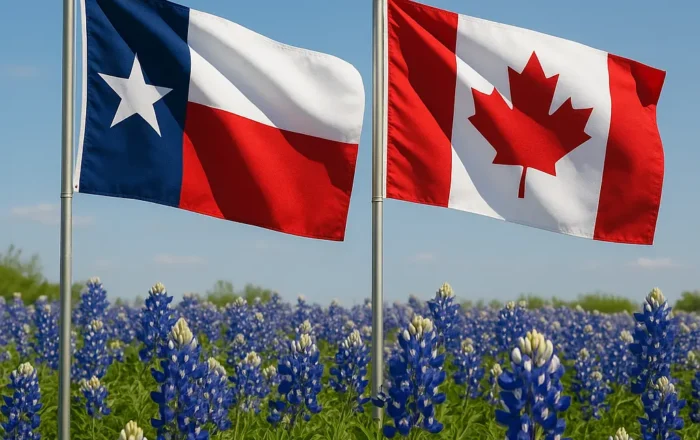

Moving to Texas from Canada: What You Need to Know

3 minute readMoving to Texas from Canada is a big lifestyle upgrade with plenty of rewards.

Home > BKV Energy Blog > All Posts > How to Buy a House in Texas: What You Need to Know

6 minute read • Last update July 2025

The Lone Star State consistently ranks among the top three states for population growth—and for good reason, as there are many compelling reasons to move to Texas.

Whether you’re already a resident, planning your move, or buying a house in Texas from out-of-state, preparation and planning are key to securing your dream home. In this guide, we’ll explain everything you need to know about how to buy a house in Texas so you can navigate the local real estate market and begin house-hunting with confidence.

Before diving head first into the process of buying a house in Texas, there are a few crucial factors you must familiarize yourself with:

By carefully weighing these considerations along with the various other pros and cons of moving to Texas, you can plan and budget more efficiently.

Now you’re familiar with the background information, it’s time to work through each stage of the process in steps. To buy a house in Texas with minimal stress, we recommend the following strategy.

Developing a solid understanding of your financial situation is essential before buying property in Texas. In addition to accessing your credit report, you’ll need to gather other relevant documents to apply for a mortgage loan or down payment assistance. Examples include proof of gross monthly income, bank statements, W-2 forms, and your tax returns.

Securing a mortgage pre-approval letter is an essential aspect of the home-buying process because it shows sellers that you’re a serious contender. It pays to shop around and compare interest rates from multiple lenders to get the best deal. You’ll also need to plan ahead, as it typically takes seven to sixty days for any mortgage lender to review your income, employment history, and credit score to assess your debt-to-income ratio.

Contracting a knowledgeable local real estate agent is essential for navigating the complexities of buying a house in Texas. Non-residents, in particular, will benefit from the experience of tenured agents who can provide valuable insights into neighborhoods, pricing, and potential issues. Due to recent changes in state legislation, buyers must pay their own agent commission, which is typically around 2.87% of the property value.

With your finances in order and an agent by your side, it’s time to start looking for your new home. Presumably, you’ll already have researched the broad options, such as moving to Dallas or relocating to Houston. You’ve likely also considered a list of the safest cities and the best cities for families. Now it’s time to fine-tune the details by exploring neighborhoods across Texas that fit your lifestyle and budget.

Once you find a home you love, work with your agent to submit a competitive offer. Factors to consider include:

Remember that in a seller’s market (where demand outpaces supply), you may need to offer more than the asking price.

Texas laws require sellers to disclose any known issues; however, an independent inspection may still prove invaluable in uncovering hidden problems, such as structural damage or pest infestations before buying a house. Texas home inspections cost between $200 and $500 on average—a small price to pay for peace of mind.

If any issues are discovered, you can ask the seller to fix them or negotiate a lower price before settling on a closing date. The best real estate agents will help you navigate these discussions, ensuring that all contingencies are included in your contract to protect you from unforeseen issues in the closing process.

Obtaining homeowners insurance is one of the mandatory requirements to buy a house in Texas if you’re purchasing through a mortgage lender. Prices vary based on factors like location and the home’s value. However, the average cost of annual home insurance in Texas is around $4,400. This is over double the national average of $1,915. So, it pays to shop around for policies that offer the best coverage for your needs.

To finalize the sale, you’ll need to sign all the necessary documentation and pay closing costs, which are usually around 2-5% of the purchase price. Closing costs typically include:

Reviewing the closing disclosure form carefully is essential to avoid any unexpected charges.

After closing, it’s time to move into your new Texas home! This is the exciting part, where you get to pick out fixtures, flooring, furnishings, etc. To ensure a smooth transition, you’ll also need to set up utilities, including water, gas, and electricity. Remember that Texas has a deregulated energy market, so it’s always worth exploring your options thoroughly to find the best plan.

With the nuts and bolts of how to buy a home in Texas covered, let’s get you up to speed with a checklist of what you’ll need before you get started:

Understanding these requirements helps prepare you for the financial commitment involved in buying a house and empowers you to approach lenders with confidence.

Here’s a comprehensive list of the various government-backed loans and payment assistance programs available to eligible homebuyers:

These financial assistance programs are designed to make homeownership more accessible. Researching and applying for these programs early in your journey can provide significant advantages and open doors to opportunities you may not have thought possible.

We hope you’ve found our information and resources about how to buy a house in Texas helpful in your research and planning. As you embark on your exciting homeownership journey, don’t forget to consider ongoing living expenses like utilities.

At BKVE, we offer a variety of Texas electricity plans tailored to fit your needs and budget. Whether you prioritize competitive pricing, renewable energy options, or flexible payment plans, we have something for everyone.

Enter your zip code today to compare your options and find your plan.

Graham Lumley, Digital Marketing Manager at BKV Energy, leads digital and traditional marketing strategies, focusing on educating Texans about the state's deregulated energy market. With over 8 years of marketing experience, he creates content to help consumers understand and save on their energy bills, bringing a fresh and dynamic approach to the industry.

Moving to Texas from Canada is a big lifestyle upgrade with plenty of rewards.

Texas migration in 2025 continues to accelerate, reshaping the state’s biggest metros.

Get $50 off your electric bill!

Use code BKVEJOINUS50

Enter your zip code to shop BKV Energy's affordable, fixed-rate Texas electricity plans. Use the promo code for $50 off your electric bill.